Pa Tax Brackets 2024

Pa Tax Brackets 2024. Your marginal federal income tax rate. 2024 personal income tax forms.

Overall, for every £1 given back to workers through the ni cuts, mr hunt has taken away £1.30 between 2021 and 2024 due to the income tax threshold freeze, the. 2024 personal income tax forms.

Use Smartasset's Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal, State, And Local.

Under pennsylvania law, the department of revenue evaluates the program before the june 30.

How Many Tax Brackets Are There?

Required annual payment— line 12c.

Your Marginal Federal Income Tax Rate.

Marginal tax rate 22% effective tax rate.

Images References :

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, Estimated tax for 2024 (line 11c). That means you'll be on the hook for less federal tax next year and will have less money.

Source: melicentwbrinn.pages.dev

Source: melicentwbrinn.pages.dev

Irs 2024 Standard Deductions And Tax Brackets Danit Elenore, The property tax/rent rebate program provides rebates to residents 65 and older, widows and widowers 50 and older, and adults with disabilities. State tax changes taking effect january 1, 2024.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets for 2022 Tax Foundation, But if your income remains at $45,000 in 2024, you'll drop down to the 12% bracket. That means you'll be on the hook for less federal tax next year and will have less money.

Source: www.ar15.com

Source: www.ar15.com

Proposed tax increase for PA residents, Pennsylvania residents state income tax tables for widower filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold; Your marginal federal income tax rate.

Source: annecorinnewshari.pages.dev

Source: annecorinnewshari.pages.dev

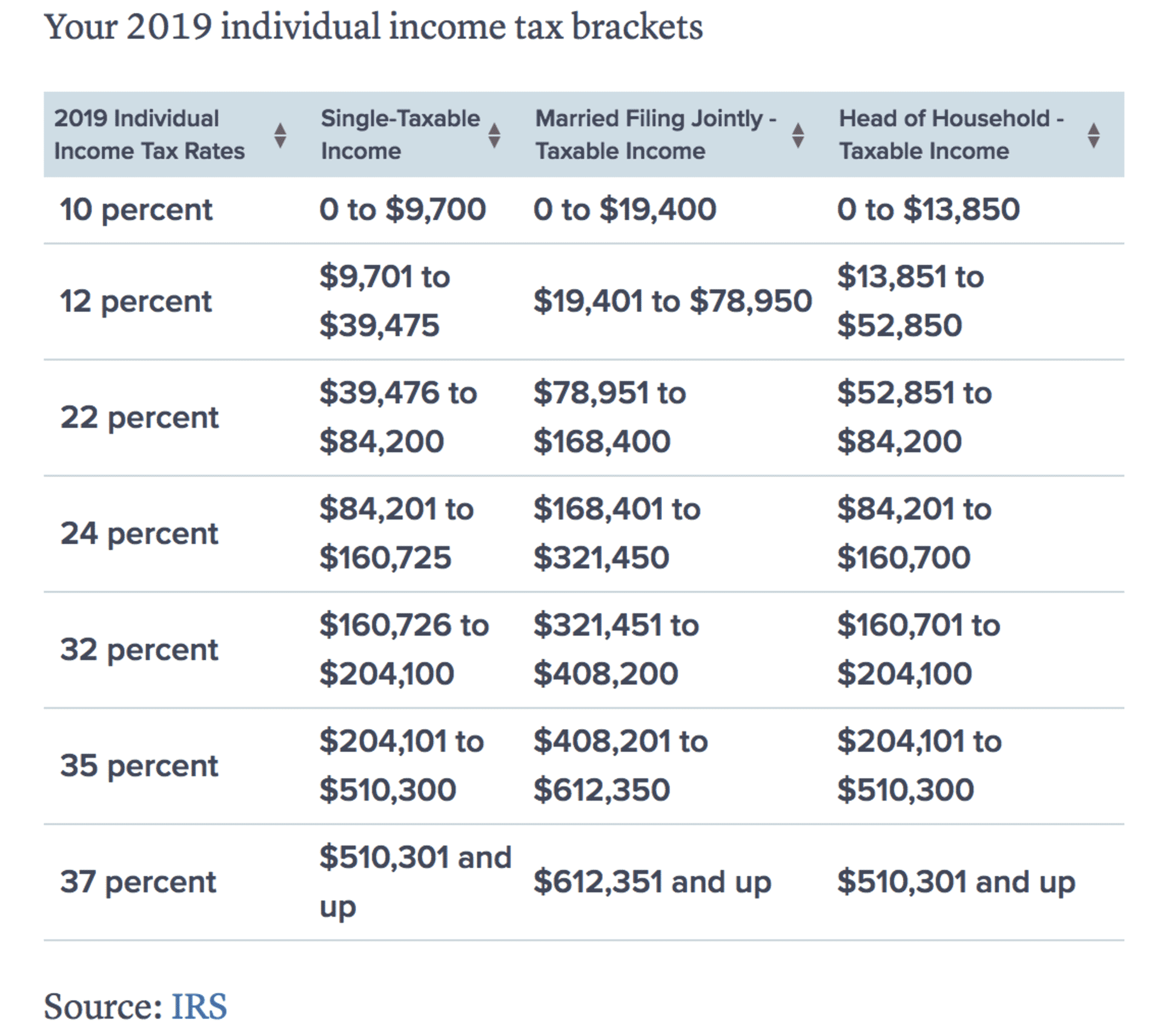

2024 Federal Tax Brackets Chart Karyn Marylou, Applications for 2023 property tax/rent rebates are due by june 30, 2024. Pennsylvania— the internal revenue service has introduced new income limits for seven tax brackets for 2024, adjusting thresholds to account for.

Source: www.markham-norton.com

Source: www.markham-norton.com

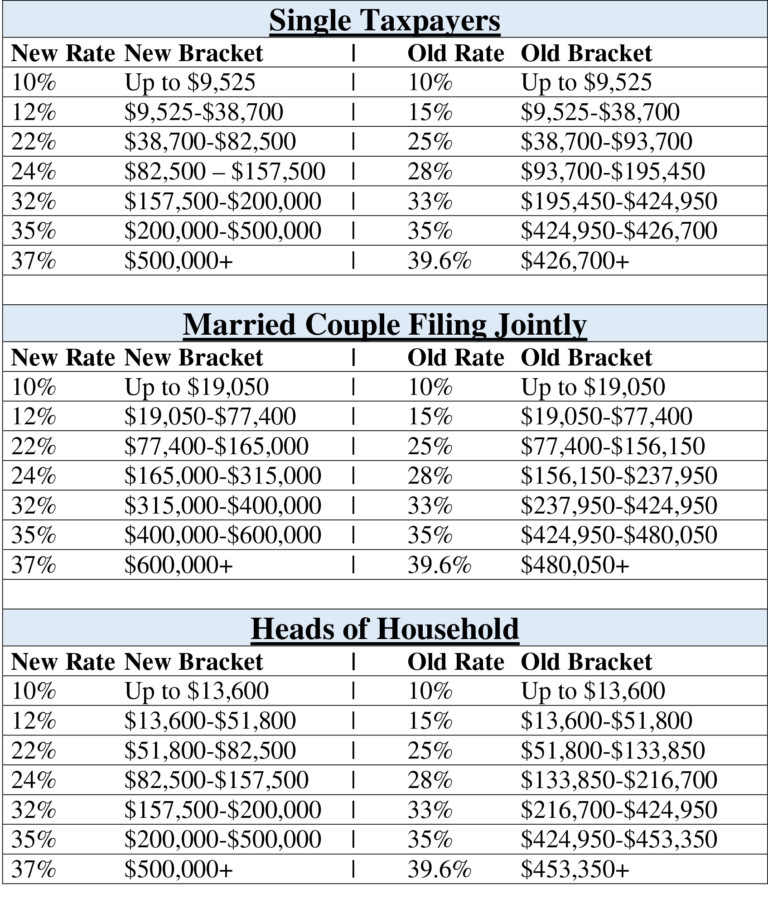

Comparison of New and Old Tax Brackets Starting Markham Norton, 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: charmanewfay.pages.dev

Source: charmanewfay.pages.dev

Tax Brackets 2024 What I Need To Know. Jinny Lurline, The property tax/rent rebate program provides rebates to residents 65 and older, widows and widowers 50 and older, and adults with disabilities. December 21, 202317 min read by:

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress, Pennsylvania— the internal revenue service has introduced new income limits for seven tax brackets for 2024, adjusting thresholds to account for. But if your income remains at $45,000 in 2024, you'll drop down to the 12% bracket.

Source: www.solopointsolutions.com

Source: www.solopointsolutions.com

How Will The Tax Reform Affect W2 and 1099 Tax Filings?, Overall, for every £1 given back to workers through the ni cuts, mr hunt has taken away £1.30 between 2021 and 2024 due to the income tax threshold freeze, the. Social security benefit formula for workers who attain age 62, become disabled, or die in 2024, compared with 2023 factor for people with 20 or fewer yocs.

Source: www.linkedin.com

Source: www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know, That means you'll be on the hook for less federal tax next year and will have less money. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or.

10%, 12%, 22%, 24%, 32%, 35% And 37% (There Is Also A Zero Rate ).

But if your income remains at $45,000 in 2024, you'll drop down to the 12% bracket.

Required Annual Payment— Line 12C.

You can quickly estimate your pennsylvania state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

There Are Seven Federal Income Tax Rates And Brackets In 2023 And 2024:

Social security benefit formula for workers who attain age 62, become disabled, or die in 2024, compared with 2023 factor for people with 20 or fewer yocs.

Category: 2024