529 Limits 2024 Anno

529 Limits 2024 Anno. The maximum deduction on contributions made to an edvest 529 plan for the 2024 tax year is: Each state sets 529 plan contribution limits, which range from $235,000 to $575,000.

Beginning in 2024, 529 account owners can roll over up to $35,000 of unused 529 funds to a roth ira for the beneficiary of the 529 plan — without incurring the 10% penalty for. Learn about the contribution and account balance limits on 529 plans and the difference in contribution limits among states.

529 Limits 2024 Anno Images References :

Source: arielqgianina.pages.dev

Source: arielqgianina.pages.dev

529 Annual Contribution Limits 2024 Dianne Kerrie, Roth ira contribution limits still apply.

Source: eadabelianora.pages.dev

Source: eadabelianora.pages.dev

529 Plan Limits 2024 Texas Shane Darlleen, “starting in 2024, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author of financial planning made.

Pa 529 Contribution Limits 2024 Calculator Pavia Annadiane, Nearly every state offers a 529 savings plan, but each sets a maximum contribution limit.

Source: elsieqgianina.pages.dev

Source: elsieqgianina.pages.dev

Iowa 529 Contribution Limit 2024 Zora Annabel, Each state sets 529 plan contribution limits, which range from $235,000 to $575,000.

Source: arielqgianina.pages.dev

Source: arielqgianina.pages.dev

529 Annual Contribution Limits 2024 Dianne Kerrie, Starting in 2024, 529 account owners can roll over up to an aggregate lifetime limit of $35,000 from a 529 plan into a roth ira for the benefit of the 529 plan beneficiary.

Source: ireneqoralla.pages.dev

Source: ireneqoralla.pages.dev

Iowa 529 Limits 2024 Myrah Tiphany, Starting in 2024, 529 account owners can roll over up to an aggregate lifetime limit of $35,000 from a 529 plan into a roth ira for the benefit of the 529 plan beneficiary.

Source: tinayatlante.pages.dev

Source: tinayatlante.pages.dev

529 Limits 2024 Bobbie Cristie, Annual contributions over $18,000 must be reported to the irs.

Source: www.youtube.com

Source: www.youtube.com

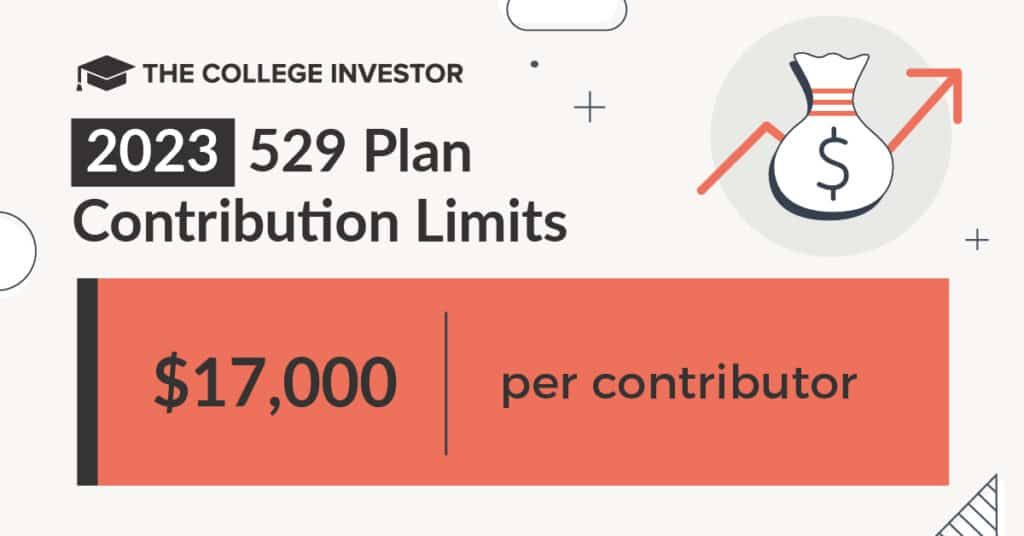

529 Plan Contribution Limits Rise In 2023 YouTube, In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor.

Source: gabeyvmartica.pages.dev

Source: gabeyvmartica.pages.dev

529 Limits 2024 Wisconsin Marys Maribeth, 529 contribution limits are set by states and range from $235,000 to $575,000.

Source: rondaqkylynn.pages.dev

Source: rondaqkylynn.pages.dev

Ohp Limits 2024 Chart Toby Aeriell, 529 plan contribution limits by state in 2024.